Hurricane Irma

On the heels of one of the largest natural disasters in U.S. history, Hurricane Irma roared into the Carribean with record force early today with 185 mph winds, shaking homes and flooding buildings on a chain of small islands along a path toward Puerto Rico, the Dominican Republic, Haiti, Cuba and likely Florida by this weekend.

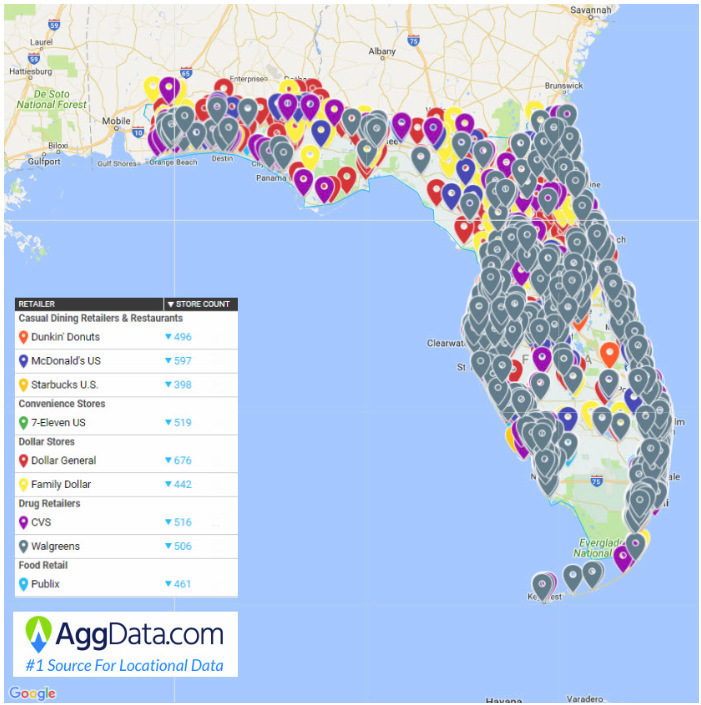

Earlier today, Fox News utilized Aggdata’s list of 50 major retailers/restaurants with significant exposure in Florida, including Advance Auto (11.79%), Walgreens (10.43%), CVS (9.03%) and GNC (9.02%), Dunkin Brands (9.78%) and Wendy’s (8.17%).

The full geo-coded list of 14,000 retail locations for this group of retailers that could be affected by Hurricane Irma can be accessed by clicking here.

Kroger

Last week, Kroger amended its $2.75 billion unsecured revolving credit agreement with Bank of America, N.A. and Wells Fargo Bank N.A., as co-administrative agents. The amendment extends the maturity date to August 29, 2022, from June 30, 2019, and allows the Company to increase the size of the facility by up to an additional $1.00 billion (previously $750.0 million), subject to certain conditions.

As of May 20, 2017, the Company had no revolver borrowings, $6.1 million of letters of credit and $880.0 million in commercial paper outstanding under the facility.

Yesterday, Kroger announced that about 11,000 employees working at 105 Kroger stores in the Dallas/Ft. Worth and East Texas areas ratified a new labor agreement with UFCW Local 1000.

In other news, Kroger is expanding its Prep + Pared meal kits to additional stores in Cincinnati and Dayton, OH, and adding recipe offerings. Its meal kits will be offered in about 40 stores by the end of September.

Lastly, Kroger announced the retirement of Michigan division president Jayne Homco, effective September 30. Scott Hay, currently VP of operations for the Company’s Fry’s division, will succeed her.

Five Below

Five Below’s second quarter sales increased 28.7% to $283.3 million, and comps were up 9.3%. Profit rose 70.7% to $16.8 million. The Company opened 31 new stores during the quarter, ending with 584 stores operating in 32 states, an increase of 18.9% from the prior year. CEO Joel Anderson stated, “We exceeded the high end of our sales, comp and earnings outlook. Sales growth of 29% was led by strong new store performance and our transaction-driven comp of 9.3%, which was the highest since our IPO. We saw solid broad-based performance across our worlds, with notable contribution from the spinner trend. Our top line results were accompanied by strong margin expansion, resulting in over 70% net income growth.”

Hy-Vee

Last week, Hy-Vee announced plans to build and operate 26 Wahlburgers restaurants in seven states, becoming the largest franchisee of the casual burger chain associated with actor Mark Wahlburg, which currently operates 17 locations in nine states. Hy-Vee will open its first location next year in West Des Moines, IA. In addition, Hy-Vee said it would add Wahlburgers-branded menu items to all 84 of its Market Grille in-store restaurants.

That same day, Hy-Vee also announced a partnership with Orangetheory Fitness that would provide customers with access to group fitness programs in or adjacent to Hy-Vee stores. The partnership creates an integrated fitness component to bolster Hy-Vee’s focus on health and wellness — including in-store dietitians, HealthMarkets, chefs, fresh and organic produce and pharmacies. Orangetheory Fitness currently has 750 studios nationwide, and plans for 1,500 in the next two years. The first Hy-Vee Orangetheory Fitness location will open in 2017 in the Twin Cities.

Meanwhile, after years of delay, Hy-Vee is expected to begin work this fall on the planned Coralville, IA location, with an opening date set for summer of 2018. The scaled down version of the store is expected to be 85,000 square feet, rather than the originally planned 96,000 square feet. The store's closest competition will be a Fareway about a mile north and an Aldi, Walmart and Costco about two miles south. Meanwhile, a new Trader Joe's is expected to open nearby in October. Hy-Vee already operates a store in Coralville and has seven stores in Cedar Rapids, one in Marion and three in Iowa City.

Hudson's Bay Company

Hudson’s Bay Company reported second quarter sales increased 1.2% to $3.29 billion, and comps were up 0.4%. Comps were up 1.7% at Saks Fifth Avenue but down 1.6% at DSG (department store group), 2.3% at HBC Off Price and 2.8% at HBC Europe. Digital sales increase 12.7%, and digital comps were up 11%. However, net loss widened 41.5% to $201.0 million. The Company continues to feel pressure from U.S. activist investor Land and Buildings Investment Management LLC (which owns a 4% stake), who is urging the Company to consider strategic initiatives including going private, divesting its European business, or monetizing its real estate holdings, valued at about $10.00 billion. Executive Chairman Richard Baker commented, “Heading into the fall season, we are optimistic about the remainder of the year. The current retail environment provides both challenges and opportunities, and while it was a tough second quarter as expected, we continue to make the smart decisions necessary to succeed in this rapidly evolving landscape.” During the quarter, the Company opened three new Saks Fifth Avenue stores, 26 new Saks Off 5th stores, and five new Saks Off 5th Europe stores. Yesterday, HBC opened its first of 20 planned stores in The Netherlands, its first foray outside of Canada. The Amsterdam store will be joined by nine more locations before the end of the month, and another five set to open each in 2018 and 2019. The Company is taking advantage of freed up retail space from the bankruptcy of Dutch department store chain V&D, which had operated 60 stores in the country.

Lidl

Published reports indicate that Lidl submitted plans to open stores in Ohio. The first is slated to open in Broadview Heights, a suburb of Cleveland, in 2020. Other applications have been submitted for stores in Howland and Austintown, with more expected.

Since its first wave of openings in June, the Company currently operates 22 stores in the southeastern U.S. According to its website, Lidl is looking for possible other new sites in Texas, Ohio, Virginia, Georgia, South Carolina, North Carolina, Pennsylvania, Maryland, New Jersey and Delaware.

Dick's Sporting Goods

Dick’s Sporting Goods plans to open six namesake stores and two Field & Stream stores in the first half of September, including one Dick’s that already opened on September 1 in Sacramento, CA. The remaining Dick’s stores scheduled to open on September 15 include Medford, MA; Northbrook, IL; Pooler, GA; and Roseville and Fairfield, CA. One of the Field & Stream stores opened on September 1 in Barboursville, WV, while the other is scheduled to open this Friday in Scranton, PA. The openings will bring the Company’s store count to 711 Dick’s locations and 34 Field & Stream locations.

Fresh Encounter

Ohio- based Generative Growth II (affiliated with Fresh Encounter), which purchased 15 Marsh Supermarkets in June for $8.0 million, recently announced that all but one of the stores will operate as Needler’s Fresh Market, a newly created banner. The remaining store will operate under the Chief Supermarket banner. Fresh Encounter has 59 grocery stores in Indiana, Ohio and Kentucky under the Sack ‘N Save, King Saver, Chief, Great Scot, and Community Markets banners. Generative Growth II said it will complete the interior and exterior branding of the Needler’s Fresh Market locations by the end of October. Last week, Cooley LLP, Attorney for the Creditors Committee in the Marsh Supermarkets bankruptcy case, confirmed that all Marsh assets have been sold; Marsh was administratively solvent and all undisputed 503b9 claims have been paid. The attorney also noted that the committee was exploring a possible settlement with Sun Capital and that a plan could be filed in the next few months.

Conn's

On September 1, Conn’s issued an update on the status of its stores after Hurricane Harvey made landfall on August 25, 2017. About 55, or 47% of the Company’s stores are located in Texas, and six, or 5% of its stores are in Louisiana. As a result of the hurricane and unprecedented levels of rain and flooding, Conn's said it closed 23 stores, its distribution and service centers in Beaumont and Houston, as well as its Beaumont corporate office. The Company's corporate offices in The Woodlands and San Antonio remained open, and they supported operations outside the path of the storm. Management said all but two stores are now open for business. The Company also reopened its Beaumont corporate office, and distribution and service centers. Conn's said it has currently lost 100 store-days between August 25, 2017 and September 1, 2017. Despite the severe impact of Hurricane Harvey, this number of lost days compares favorably with both the impact of Hurricane Rita, which caused 134 lost store-days and Hurricane Ike, at 144 lost store-days. The Company said it will provide more detailed information and analysis on the impact of Hurricane Harvey when it reports second quarter fiscal year 2017 results on Thursday September 7, 2017. Even though most of the Company’s stores are open, it may take time for shoppers to return to the stores. An interruption of business caused by the hurricane comes at a critical time for the Company, which has already said it anticipates comps falling between 12% and 15% in the 2017 second quarter. Conn’s has been struggling with operational issues stemming from an aggressive expansion program and a relaxation of its underwriting standards. This led to an increase in delinquencies and bad debt expense as well as a deterioration in profitability.

Smart & Final

Last week, Smart & Final debuted its own virtual grocery site that offers same-day delivery through Instacart. Smart & Final first partnered with Instacart in 2015, but users accessed Smart & Final’s offerings through Instacart’s mobile app. Smart & Final previously said it experienced strong, consistent results related to the Instacart partnership, which had “15 times sales growth” since its initial collaboration. Instacart is currently available at about half of the 253 Smart & Final stores.

Amazon

As part of Amazon’s acquisition of Whole Foods, Amazon already slashed prices at Whole Foods stores and bean offering WF goods through the Amazon website. Amazon is now installing lockers at some Whole Foods retail locations allowing customers to pick up items ordered through Amazon, and make returns. Amazon currently offers 2,000 locker locations across more than 50 cities.

A recent Moody’s report asserts that “Amazon.com, Inc. is still a long way from dominating the U.S. retail market. Although its acquisition of Whole Foods, Inc. likely helped fuel perceptions that it is outdoing the major retailers and is on its way to taking over the food retail business, these views aren't borne out by the math.” According to Moody’s, “online sales still account for only about 10% of overall U.S. retail sales, with a much lower percentage in the grocery segment, leaving the big brick and mortar retailers, led by Walmart, still really formidable competitors in the industry." The report continues, “far from dominating the retail sector, [Amazon] is actually the weakest of the big U.S. players based on operating results.” The Moody’s report also challenges estimates that Amazon Prime has 85 million members, and suggests that the number could be as low as 50 million. It points out that this is lower than the 86.7 million people who are Costco members.

Whole Foods will open a new store in Buffalo, NY, its first in Western New York State. The 50,000 square-foot store will include a bocce ball court as part of the store’s café space, as well as a variety of dining options. Another 44,000 square-foot store will open in Dallas, TX, its 14th in the greater Dallas area. Both are expected to open later this month.

In other news, Amazon has been approved for an estimated $7.8 million tax credit for a new fulfillment center in North Randall, outside Cleveland, OH. The 855,000 square-foot center is set to open in 2018.

Amazon will reportedly launch its Prime Now service in Canada by the end of the year. It will first be offered in Vancouver in November as part of a pilot program, followed by Toronto in January 2018. If the test goes well, the Company will expand the service to additional regions next year.

Sears Hometown and Outlet

Sears Hometown and Outlet Stores reported second quarter sales decreased 11.9% to $490.0 million, and comps were down 2.1%. Hometown comps were down 0.9%, while Outlet comps declined 5%. The Company recorded a net loss of $29.4 million, compared to a profit of $10.6 million last year. Second quarter results include charges of $12.6 million related to the Company’s accelerated store-closing initiative (81 stores were shuttered during the quarter) and $5.6 million related to the write-off of, and additional reserves taken on, franchisee notes receivable (14 Outlet stores were acquired from a franchisee during the quarter). In the prior year period, the Company recognized a $25.3 million gain related to the sale of an owned property in San Leandro, CA. Commenting on second quarter results, CEO Will Powell stated, “Our reported results for net loss and loss per share were unfavorable to the prior year primarily due to the charges and IT infrastructure investments incurred this year and the recognition in the prior year of a $25.3 million gain on sale of assets. However, our continuing progress to transform our business is evidenced by our year-over-year adjusted EBITDA improvement in the second quarter. We still have much work ahead to complete our transformation efforts, but it is apparent that many of the initiatives that we are pursuing are positively impacting our business including attracting new customer segments, transitioning to a fully-integrated omni-channel customer experience, optimizing our store portfolio, and improving our merchandise assortments.” During the quarter, the Company converted 74 stores to the America’s Appliance Experts format, which it says consistently outperforms other stores.

Casper

Casper has announced it will be opening about brick and mortar stores; a departure for the startup, which built its reputation on the ease of buying a mattress online and having it delivered. Last year, the company partnered with West Elm to bring Casper mattresses into the furniture stores, and, this summer, they’ve inked a similar deal with Target. Some 15 Casper-owned retail pop-ups will open in urban centers across North America, where people will be able to try out the new premium Casper Wave in person before shelling out $1,850 to take it home. The stores will also sell Casper bedding and the original mattress design.

PetSmart

Chewy.com, which was acquired by PetSmart in April for $3.35 billion, announced plans for an 820,000 square-foot distribution center in Goodyear, AZ. PetSmart operates 55 stores in Arizona. Goodyear is already home to a number of big distribution centers including Amazon and Macy’s. Aldi and UPS are also planning big centers in Goodyear.

Casey's General Stores

Casey’s reported first quarter sales growth of 6.3% to $2.09 billion. Comps increased in all business segments, including 3.1% for Grocery and Other Merchandise, 3.7% for Prepared Food and Fountain, and 1.7% for gallons of fuel sold. Operating expenses increased 10%, to $321.2 million, primarily due to accelerated recognition of compensation expense for the 2017 long term incentive program, operating 47 more stores compared to the same period a year ago, the continued rollout of growth programs in additional stores (expanded hours at select locations, stores with pizza delivery, and major remodels), and wage rate increases. Net income fell 15.8%, to $56.8 million, impacted by long-term stock incentive plan expenses and higher Illinois state tax rates.

During the quarter, the Company opened two new stores, acquired three, completed one replacement, and remodeled 11 stores. There are currently 47 new stores, 27 replacement stores, and 16 major remodel stores under construction. Additionally, the Company has 132 sites under agreement for new store construction and 18 acquisition stores under agreement to purchase. Based on the ongoing softening of traffic experienced in the first quarter, the Company revised its prepared food and fountain same-store sales guidance to between 4% and 6% from 5% to 7%. Also, due to the continued increase in new store construction activity and the number of acquisition stores under agreement, the Company revised its expansion guidance to build or acquire 90 to 120 stores from 80 to 120 stores.

Dollar General

Dollar General reported second quarter sales growth of 8.1% to $5.83 billion, driven by sales from new stores. Comps increased 2.6%, from increases in average transaction amount and customer traffic. Comps reflect positive results in the consumables and seasonal categories, partially offset by negative results in the home products and apparel categories. Nevertheless, comps in non-consumables categories were positive. Net income fell 3.8% to $294.8 million. During the first half of the year, the Company opened 574 new stores and remodeled or relocated 55 stores.

On June 12, 2017, the Company finalized the purchase of Family Dollar stores from Dollar Express, resulting in a net increase of about 285 new stores in 35 states. The Company plans to convert these locations to the Dollar General banner by the end of November 2017.

Dollar General raised its fiscal 2017 guidance and now expects EPS of $4.35 – $4.50, compared to prior guidance of $4.25 – $4.50. It expects comp growth to be at the upper end of its guidance of slightly positive to an increase of 2%, and sales to increase 5% – 7%. Expected capex remains $715.0 million – $765.0 million. For fiscal 2017, the Company plans to open approximately 1,285 new stores, which includes the acquired stores, in addition to remodeling or relocating 760 stores.

Cato/The Buckle/L Brands

On August 31, Cato Corporation, The Buckle and L Brands reported their August 2017 comparable store sales. Overall, weak foot traffic trends continued for all of the Companies and will likely continue for the remainder of 2017. In addition to foot traffic, Cato continues to face merchandise assortment challenges due to aging inventory, Buckle is facing headwinds with its premium pricing on apparel and L Brands continues to attribute its sales decline to the exit of the swim and apparel categories (which the Company initiated exiting in Q2 of 2015). Cato’s CEO John Cato stated, “Negative sales trends persisted in August and continue to put severe pressure on merchandise margins and profitability. Correcting the missteps to our merchandise assortment is taking longer than expected and will continue throughout the back half of the year.” L Brands’ chief investor relations officer commented, “The exit of swim and apparel negatively impacted total Company August comps by about 2 points. The August merchandise margin rate was about flat to last year. Inventories per square foot ended the month down 7% versus last year. We expect September total Company comps to be down low single digits, which includes a negative impact from the exit of swim and apparel of about 2 points.” In addition, L Brands’ sales for the 30 weeks ended August 26 decreased 5% to $6.03 billion, and comps were down 8%. Cato’s sales for the same period declined 15% to $498.9 million, and comps fell 15%. Buckle’s year-to-date sales decreased 10.1% to $488.2 million, and comps were down 10%.

Wawa

Today, Wawa broke ground on its first convenience store in Washington D.C. The 9,200 square-foot store will be the Company’s largest location so far and feature more upscale décor and offerings, including indoor and outdoor seating and an interactive digital experience. The Company reportedly plans to open 5 to 10 stores in the nation's capital over the next few years. The new store will be competing with 31 7-Eleven convenience stores located within three miles.

Alimentation Couche-Tard

Alimentation Couche-Tard reported first quarter sales growth of 16.9% to $9.85 billion. Total merchandise revenues rose 9.8% to $2.80 billion, with merchandise comps up 1.4% in the U.S. and down 0.2% in Europe and Canada. Net income was up 13% to $364.7 million, impacted by restructuring and integration costs of $30.8 million, a pre-tax net foreign exchange loss of $20.3 million, a $13.4 million tax recovery following an internal reorganization, an $11.5 million gain on the disposal of a fuel terminal in Ireland, an $8.8 million gain on an investment, as well as a $3.7 million accelerated depreciation and amortization expense in connection with the Corporation's global brand initiative.

During the quarter, the Company closed on its $4.40 billion acquisition of CST Brands; acquired 43 Company-operated sites under the Cracker Barrel brand in Louisiana; and announced an agreement to acquire Holiday Stationstores, Inc. (522 sites, of which 374 are operated by Holiday and 148 are operated by franchisees). The Company continues to roll out its new Circle K brand with about 1,800 stores in North America and nearly 1,300 stores in Europe displaying the brand.

In other news, Alimentation Couche-Tard was forced to close 120 of its convenience stores in Texas last week due to damage from Hurricane Harvey. As of August 30, 19 stores in South Texas and 71 in the Houston area remained closed. Couche-Tard has more than 700 stores in Texas, including 666 added in June from its deal to buy CST Brands. The Company said it hopes the lost revenue due to the closures will be offset by a surge in supply purchases before and after the storm, along with higher gas prices.

Costco

Costco reported August sales growth of 10% to $9.80 billion. Comps (excluding gasoline sales and the effect of foreign currency exchange) increased 5.9% and consisted of growth of 6.1% in the U.S., 4.3% in Canada, and 6.7% internationally. Comparable e-commerce sales (U.S., Canada, the U.K., Mexico, South Korea & Taiwan) were up 26%. Last week, Costco opened its ninth warehouse in Australia and its 26th in Japan.

Perfumania

Perfumania, DIP began store closing sales at the 65 stores earmarked for closure as part of its bankruptcy filing on August 26. Once the stores are closed, Perfumania will continue to operate about 160 stores. During its bankruptcy filing, the Company indicated it would reduce its retail store portfolio by accelerating the closures of underperforming stores and those stores in locations affected by declining mall traffic.

Claire's Stores

Claire’s Stores reported second quarter sales decreased 0.2% to $316.6 million; sales would have increased 0.5% excluding the impact of foreign currency exchange rate changes. Comps increased 2.8%, with North America comps up 2.6% and European comps up 3.2%. Management noted that for the fiscal 2017 third quarter-to-date period, consolidated same store sales have increased in the low single digit range, with North America performing similarly to Europe. Claire’s TTM interest coverage improved to 1.07x but remains at critical levels. During the second quarter, the Company closed 20 stores, 16 in North America and four in Europe. On its quarterly conference call, management commented that it expects store closures to continue at a similar pace but remains committed to its mall-based stores.

Dunkin Brands

Dunkin' Brands recently signed a store development agreement with franchisees QSR Group LLC and Guzaratti LLC to develop six new restaurants throughout Georgia. The first restaurant is scheduled to open in 2018. Guzaratti LLC will develop one Dunkin' Donuts location in a gas and convenience store, which is expected to open by the end of 2017.

In other news, on September 5 the Company announced that certain of its subsidiaries intend to issue approximately $1.45 billion of new securitized Notes and to use the proceeds to prepay and retire outstanding 2015 A-2-I Notes, to pay transaction fees and for general corporate purposes. At the end of 2Q17, there was approximately $733.0 million outstanding under the 2015 A-2-I Notes. A portion of the 2017 Notes is expected to be issued in the form of a new $150.0 million variable funding note facility, which will replace a 2015 variable funding notes facility. The consummation of the offering is expected to close in 4Q17.

Kinney Drugs

Kinney Drugs is acquiring two independent pharmacies in Montpelier and Waterbury, VT. The purchase is expected to close in October. The Montpelier Pharmacy will be rebranded and Waterbury Pharmacy will merge into an existing Kinney Drugs location down the street.

Ollie's Bargain Outlet

Ollies reported second quarter sales growth of 20.5% to $254.6 million, driven by a 4.5% increase in comps and additional stores. The Company opened 11 stores during the quarter bringing its store count to 250, compared to 216 stores at the end of 2Q16. Ollies’ stores average about 33,000 square feet. Net income increased 50.1% to $19.7 million, while adjusted EBITDA rose 31.6% to $34.9 million.

Looking ahead at fiscal 2017, Ollies expects sales of $1.045 billion – $1.052 billion, representing growth of 17% – 18% over 2016; comp growth of 2% – 2.5%; and EPS of $1.23 – $1.26, compared to $0.99 last year. It expects to open 33 – 35 new stores with no planned closures.

Williams-Sonoma

West Elm, a subsidiary of Williams-Sonoma, will open its second U.K. location in a London suburb this winter. The 8,000 square-foot store will open with the brand’s holiday assortment, a mix of furniture and accessories, and fair trade/handcrafted products. It will also offer Williams-Sonoma’s design consultation program, Design Crew, which pairs customers with design experts. West Elm opened its first London store four years ago. The chain operates 102 stores in the U.S., Australia, Canada and the U.K.

In other news, Pottery Barn, another Williams-Sonoma subsidiary, will open a 17,000 square-foot store in Manhattan’s Flatiron District on Friday. The store will offer design services for customers, sell a selection of one-of-a-kind vintage items, and make available in-home installation services including room painting, drapery installation, and gallery wall hanging. Pottery Barn operates 203 stores in the U.S., Canada and Australia.

Captain D's

Captain D's continues to expand in Central Florida, targeting Orlando for its next wave of expansion. The Company currently operates 29 restaurants in the state.

Vitamin World

Vitamin World’s CEO Michael Madden issued a statement saying the Company plans to file bankruptcy in order to exit real estate leases that were negotiated by its previous owners. Vitamin World, a Long Island, NY- based seller of vitamins and nutritional supplements with about 345 stores, plans to file bankruptcy as soon as this month, people familiar with the plans said. Private equity firm Centre Lane Partners acquired Vitamin World from global vitamin maker NBTY Inc last year for about $25.0 million. Mr. Madden stated, “At this time we have no other option than to restructure the company’s real estate portfolio by filing for Chapter 11 protection.”

Pep Boys

Pep Boys, a subsidiary of Icahn Automotive Group, entered into a definitive agreement to acquire Advanced Auto Service & Tire Centers. Terms of the deal were not disclosed, including a closing date. Advance operates 15 service centers in Arizona, with the majority located in the Phoenix area. These locations will be converted to Pep Boys centers. Pep Boys currently operates 20 locations within the Phoenix area.

Boll & Branch

Boll & Branch, an e-commerce bedding and bath products retailer, opened its first brick-and-mortar location in Short Hills, NJ. According to founder Scott Tannen, the roughly 2,000 square-foot store allows customers to “see, feel and experience our full product line and, following a complimentary design consultation, can place an order online with our brand associates on staff.” The Company is considering opening additional stores going forward, targeting premier shopping destinations in prominent suburbs. Boll & Branch was established in 2014 in Summit, NJ, and says it has a customer base in all 50 states ranging from young professionals to empty nesters.

There are seven home furnishings retail chains with stores located within a five-mile radius of the new Boll & Branch, including a Restoration Hardware within the same mall. Retailers also include two HomeGoods stores, two Bed Bath & Beyond stores, two Pier 1 Imports stores, and one store each of Tuesday Morning, Pottery Barn, and West Elm. However, it should be noted that most of these retailers sell a wide product range including furniture and kitchen/dining necessities in addition to bedding and bath, while Boll & Branch focuses specifically on bedding and bath products.

Dave & Buster's

Dave & Buster’s Entertainment’s second quarter sales increased 14.9% to $280.8 million driven by new restaurant openings and a 1.1% increase in comps. Comps improved primarily due to a 1.1% increase in walk-in sales and a 1.9% increase in special event sales.

During the quarter the Company opened four new locations compared to the initial guidance of two, bringing its total store count to 100 in 34 states. It opened eight locations year-to-date and an additional nine are under construction, with a total of 14 new stores opening in 2017.